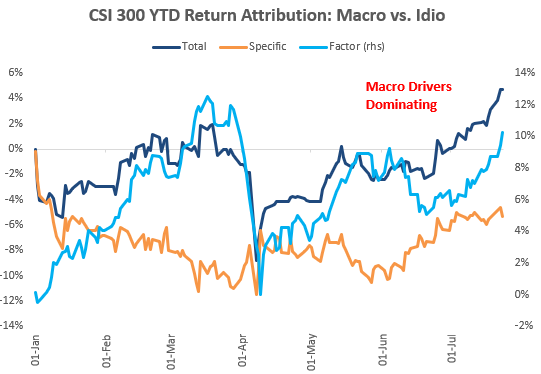

China A Shares – Macro explains almost entirety of YTD returns

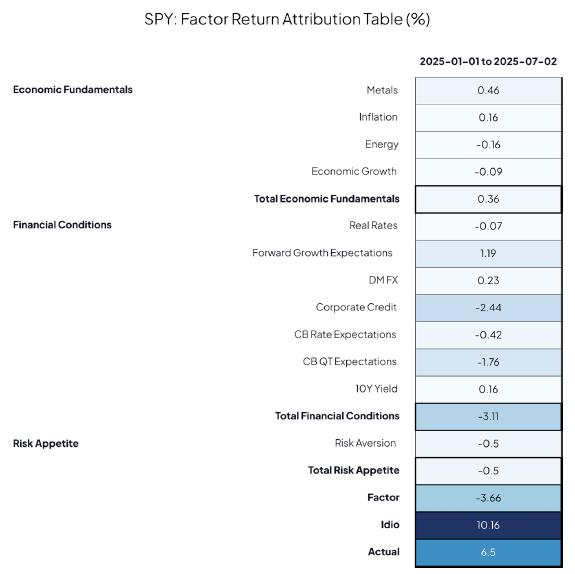

1. Small Cap rotation is hostageto inflation

2. Rate Volatility - the BlindSpot in Equity Risk

3. Rising Rate Vol - the AchillesHeel of IBB

Qi’s Risk Model attributes return & risk between macro vs. idiosyncratic / specific forces

The CSI 300is up +4.7% YTD. The make-up:

- +10.2% Macro

- -5.5% Idiosyncratic

The dominant macro propellers of that return:

- +3.8% Copper

- +1.2% USDCNH

- +1.0% China CDS

- +0.9% US HY Corporate Credit

- +0.6% China GDP

- +0.6% USD TWI

In others words, and perhaps no surprise, investing locally in China today is a punt on macro.

And nota bout a fundamental better opportunity set in anticipation of RoW fiscal stimulus / Deepseek news…

Currently the macro momentum has been strong, but be mindful of the macro risks if you are tempted to chase.