Stop Alpha Leakage

Macro is reshaping equity returns.

Isolate true alpha. Manage regime risk. Turn macro into edge.

Isolate true alpha. Manage regime risk. Turn macro into edge.

Our Partners

No items found.

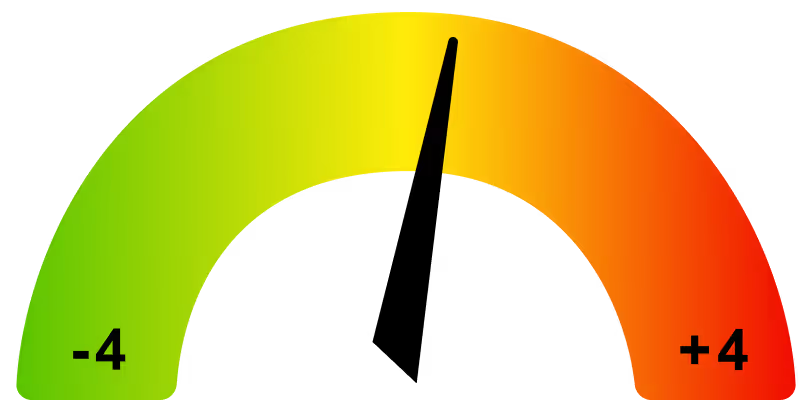

Macro Risk Pulse

The MRP is calculated using Quant Insights’ proprietary Macro Factor Equity Risk Model (MFERM)

Last updated

12

March

10:30

GMT

0.14

Bottom-up Driven

Top-down Driven

The Macro Risk Pulse (MRP) measures the proportion of total S&P500 risk explained by macro factors.

A high reading indicates that the market is predominantly driven by top-down macro factors opposed to company fundamental factors.

(The published figure is from the previous day closing data)

We manage the macro. You focus on the alpha