1. Small Cap rotation is hostage to inflation

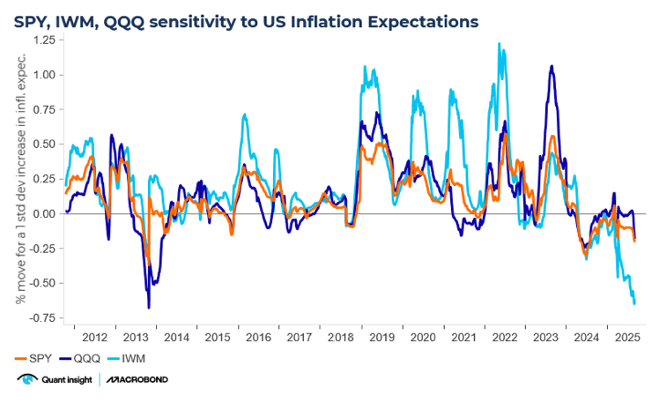

Last week's MacroVantage highlighted the S&P500's growing negative sensitivity to inflation and easier financial conditions.

That pattern is even more acute for the Russell 2000. IWM sensitivity to 5y US inflation expectations is at record lows; and IWM is noticeably more reliant on benign inflation than either SPY or QQQ.

Rotation tradesinto small caps are popular for a variety of fundamental and positional reasons. Qi observes that to work, we need to see inflation behave. Further hawkish re-pricing of inflation would be a big headwind to R2k performance relative to both Large Caps and Technology.

Read more by downloading the PDF below