Oracle Adobe Earnings

September 4, 2025

Qi Macro Valuation

1. Small Cap rotation is hostageto inflation

2. Rate Volatility - the BlindSpot in Equity Risk

3. Rising Rate Vol - the AchillesHeel of IBB

Posted on

June 2, 2025

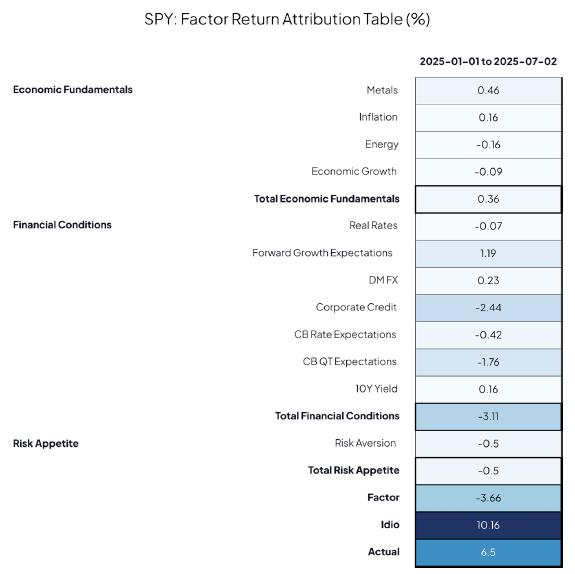

It's a big week for the AI trade with Oracle & Adobe reporting earnings.

- Oracle has had a strong run - big names like OpenAI & Nvidia use its cloud infrastructure business. That makes it a popular long for the AI theme & hence specific returns have driven performance since the April lows.

- in contrast, Adobe has yet to fully convince the market it's an AI play - they need customers to adopt the company's Firefly tools to boost revenues.

- what they have in common though is macro is a drag on both stocks. That macro headwind is abating but it is offsetting the positive returns from idio for Oracle & keeping Adobe's performance mired in negative territory.

One notable area of divergence is exposure to the Dollar -Oracle wants a stronger $, Adobe wants a weaker $.

Bloomberg charts capture what MFERM is picking up

- the weakness of the Dollar in April in the immediate aftermath of Trump's tariffs, was a major drag on Oracle.

- Adobe, however, wants a weaker Dollar (RHS inverted)

For risk managers, exposure & return attribution formacro factors such as the Dollar are now transparent & measurable.