Two Bond Signals Every Equity Investor Should Watch

1. Small Cap rotation is hostageto inflation

2. Rate Volatility - the BlindSpot in Equity Risk

3. Rising Rate Vol - the AchillesHeel of IBB

Great post from Amit Khanna – previous post- digging into the AI vs. Macro trade-off facing equities.

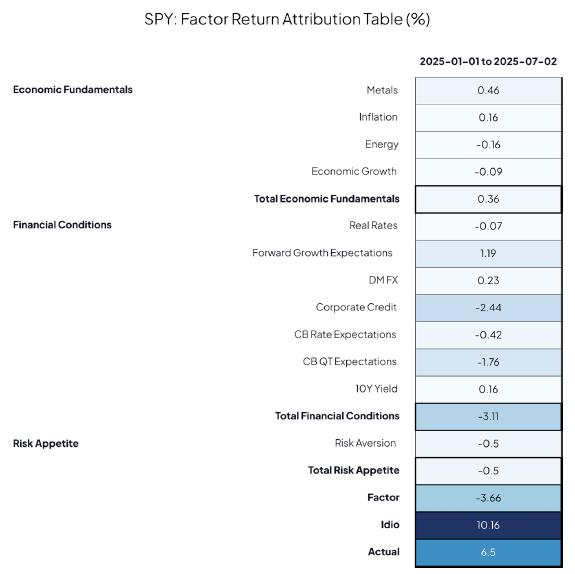

The first point nails it- bond market dynamics are critical.

But tracking moves in nominal yields, real yields, break-evens, credit spreads, and rate vol isn’t always easy for bottom-up equity investors.

Luckily, Quant Insight tracks all that & these two macro factors stand out:

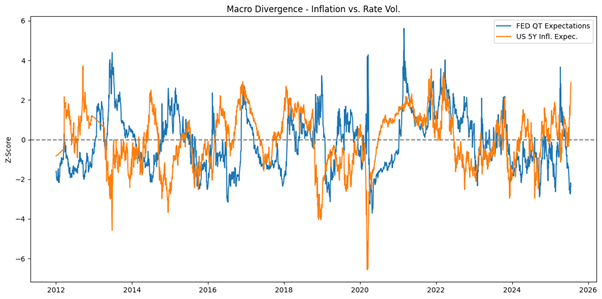

5y inflation expectations are now nearly +3 standard deviations above trend.

Tariffs + threats to Fed independence are prompting a meaningful re-pricing of inflation risks

But rate vol remains calm.

Qi uses swaption vol asour proxy Fed QT Expectations factor & its sitting 2 std dev below trend.

Both are near extremes - but pulling in opposite directions. It’s rare to see that kind of divergence.

Key takeaway?

Bonds are trading poorly but the move is NOT disorderly. That nuance matters.

Some stocks will reactto yields. Others to inflation break-evens. Still others to rate vol.

The edge lies in knowing which bond signal your single stocks are watching.