Nvidia Return Attribution Reflects Micro Optimism

1. Small Cap rotation is hostageto inflation

2. Rate Volatility - the BlindSpot in Equity Risk

3. Rising Rate Vol - the AchillesHeel of IBB

The world's second largest company by market cap reports today.

Nvidia has rallied 44% from its April 4th lows.

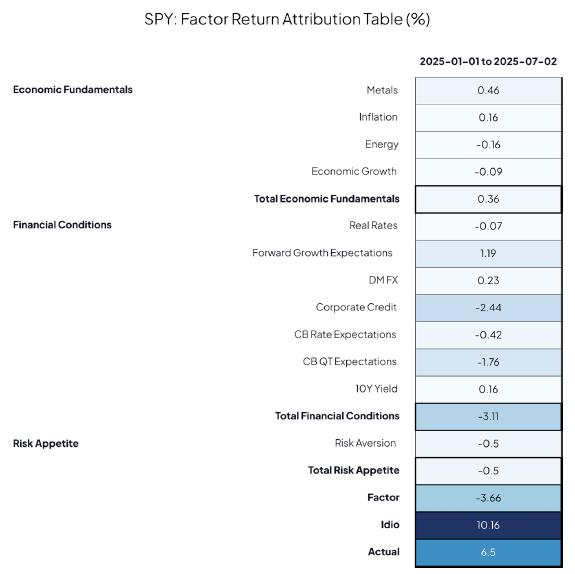

The make-up of that rally? According to Qi’s Risk Model BOTH Macro & Micro. See the first chart.

· 26% due to macro factors and the market – high beta but also benefiting from rally in 10y real yields

· 18% due non-macro / idiosyncratic drivers - likely reflectingmicro optimism

If we zoom in on that non-macro / idio component of returns, history would suggest expectations are high. See the second chart.

· An 18% idio return overthe same period, is at the upper end of the recent historical rolling range.

Nota call, but an observation to show that using Qi’s framework you can strip outt he macro noise and gauge underlying stock fundamental expectations.