1. The silent shift that could hurt equities

The S&P500 has been in strong macro regime since April (confidence >80%). But under the surface, a new regime is emerging.

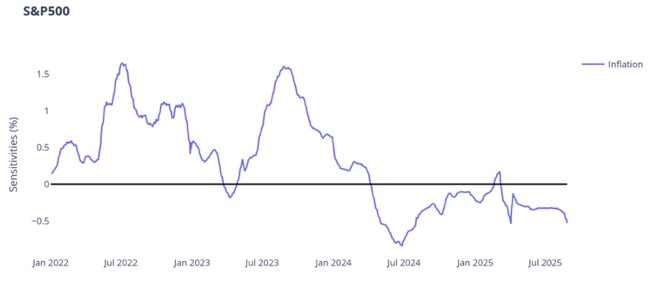

Inflation sensitivity is trending lower, nearing multi-year extremes. Equities are becoming incrementally more exposed if inflation expectations move higher.

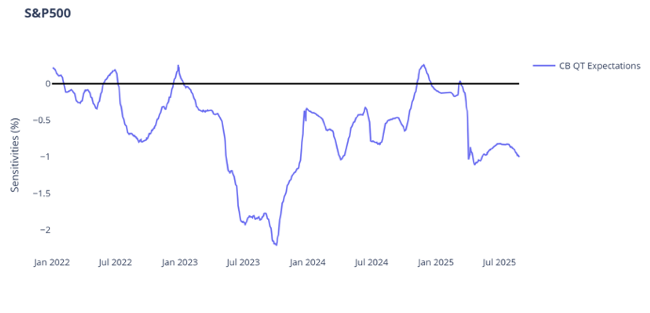

Looking further into shifts in S&P500's macro factor sensitivities reveals greater reliance on…

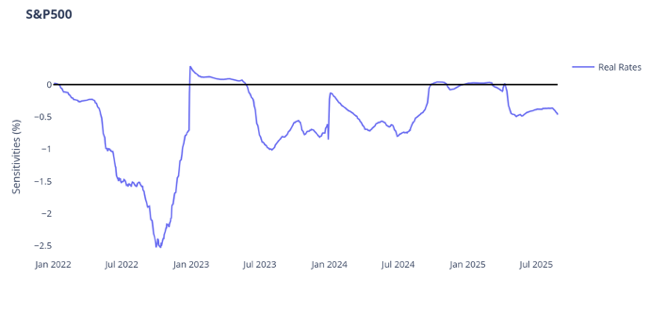

Low real yields - sensitivity is still some way from the 2022 extremes when higher real yields were the primary channel through which Fed rate hikes hurt equities, but we are approaching 2024 lows.

Tight credit spreads - same picture with sensitivity to credit spreads. Close to range lows which suggests SPX is becoming more vulnerable to any negative credit shock.

Low rate vol - growing negative sensitivity means equities are becoming more reliant on orderly interest rate markets.

For now, all these macro factors are behaving. But the point is greater sensitivity means the S&P500 is becoming more reliant on this Goldilocks scenario of benign inflation & a well behaved bond market. More than ever, equity investors need to be closely monitoring inflation and rates markets.

Read more on our other headlines this week by downloading the PDF below