1. Trading Liquidity, Not Growth — For Now

Financial conditions have mattered more than economic growth for the S&P 500, but is the regime about to shift?

Citi’s Surprise Index is at its highest since late-2023 and US GDP nowcast is running at 3.2%. Proponents of the run-it-hot economy have firm evidence the growth outlook has stepped up.

Yet US equities continue to lag DM and EM peers. Why? Because the S&P 500 has effectively zero sensitivity to economic growth right now. The index is not trading off economic data.

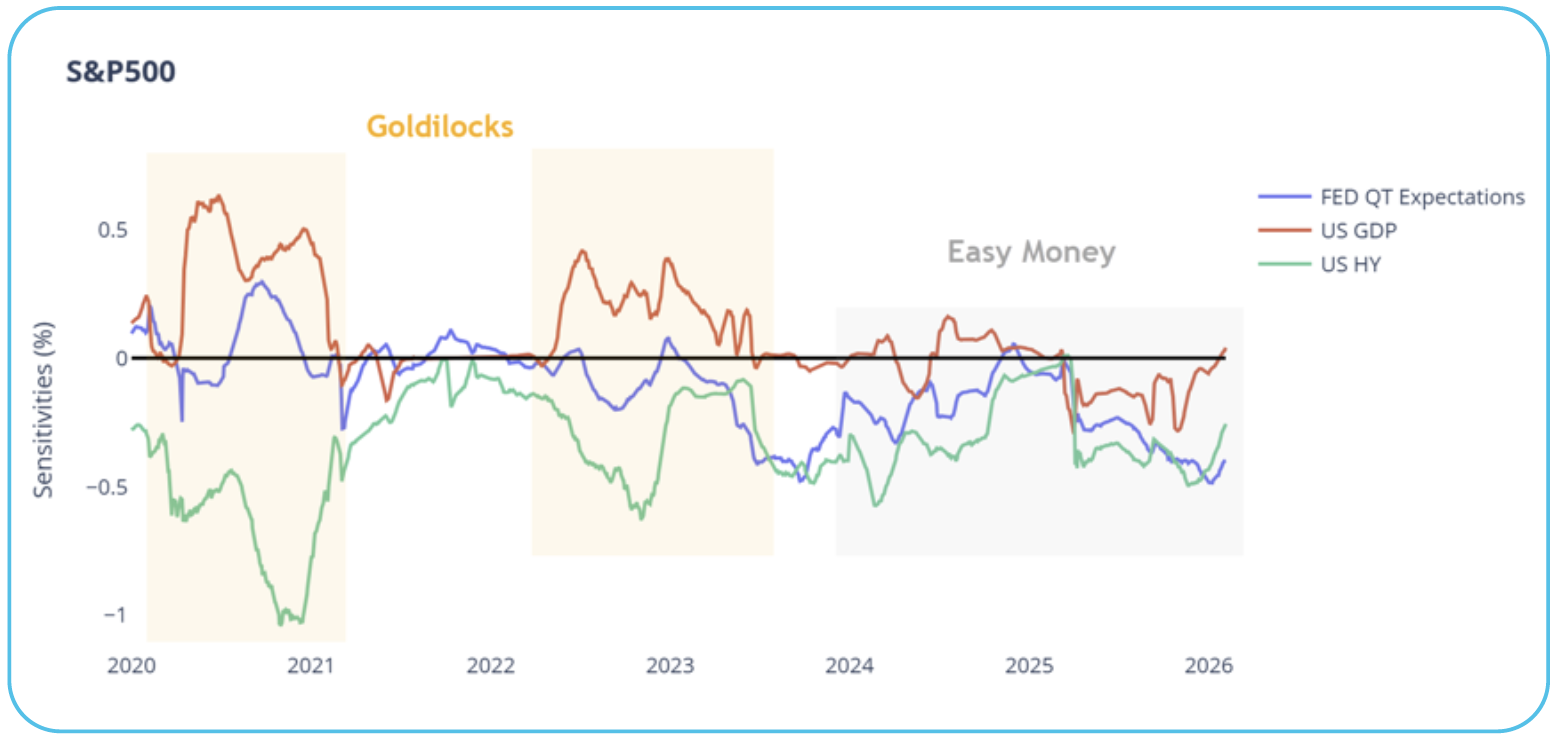

In 2020-21 and again in 2023, Qi showed the S&P 500 was in a clear Goldilocks regime - reflation plus easy money. Growth mattered.

That’s changed. The recent macro regime has been almost entirely about financial conditions. Benign rate volatility and tight credit spreads have dominated, while growth sensitivity collapsed to near zero.

There are now early signs of another shift. Sensitivity to rate vol and credit is fading, while GDP sensitivity is edging back into positive territory. If confirmed, that regime change would matter - for sector rotation, and for the US versus RoW trade.

Continue reading our analysis on the other headlines by downloading the PDF below