Inflation re-pricing divides US and European equities

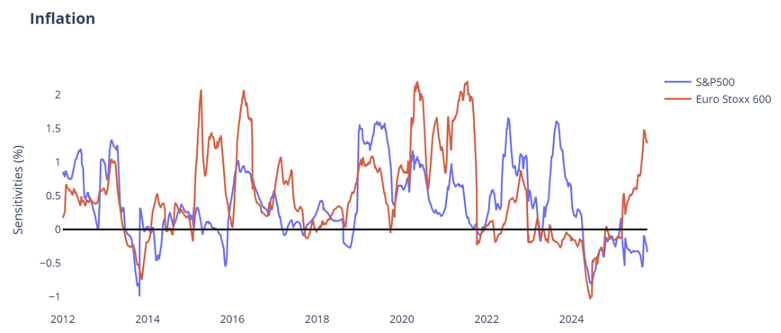

Equities usually welcome reflation - it lifts earnings. Qi’s models have long shown both the S&P 500 and Euro Stoxx 600 responding positively to rising inflation expectations.

That changed in 2024. As rate cuts became the goal, both indices flipped to negative inflation sensitivity. Falling inflation meant the Fed and ECB could cut rates.

But now there’s a break between the two regions. SPX still needs benign inflation and the Kool-Aid of Fed rate cuts; SXXP needs reflation. Put another way, US cares more about easy financial conditions, Europe about underlying growth.

That divergence shows up clearly in Qi model values. Falling US inflation barely dents S&P500’s fair value, which keeps grinding higher. And spot SPX remains aligned with macro fundamentals.

But for Europe, falling inflation bites. Stoxx 600 model value is slipping and spot has been ignoring this deterioration. It now sits 1.4σ (4.1%) rich on Qi.

Continue reading by downloading the PDF below