If Happiness = Outcome – Expectations

..then equities are in a better mood

1. Small Cap rotation is hostageto inflation

2. Rate Volatility - the BlindSpot in Equity Risk

3. Rising Rate Vol - the AchillesHeel of IBB

If Happiness = Outcome – Expectations

Then equities are in a better mood.

At least better than a month ago — climbing the proverbial wall of worry.

The question of the hour: Will the impact of tariffs show up in the data before trade talks make them irrelevant?

We may have a better idea in the coming week.

Take Consumer Discretionary - led by Tesla, the ultimate retail barometer of risk-on / risk-off. The sector is trading at ~25x 12mth fwd earnings today vs. ~20x a month ago.

Expectations are clearly high that not only is a deal with China imminent, but also the outcome will be much better than Trump’s suggestion of tariffs falling to 80%.

Fwiw, Polymarket shows ~70% odds of tariffs staying above 50%.

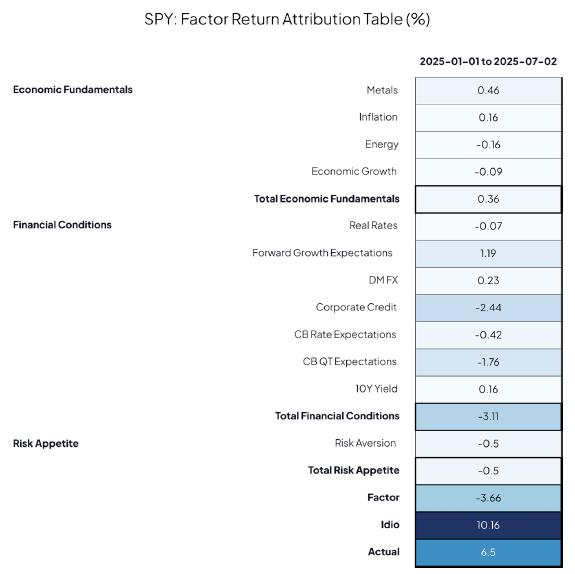

Our Risk Model allows us to benchmark these expectations against macro risk.

Our chart plots sector PE vs. its macro share of risk. We’ve shown before: when macro risk is rising, investors pay less for future earnings. So far, the recent PE expansion hasn’t been matched by a commensurate drop in macro risk.

Markets 101: stocks are forward-looking and THE leading indicator. But when uncertainty is this high…we need the facts to follow the rumours.

Data so far has been distorted by front-loading. May and June prints could be major market triggers. Our clients can track the macro share of risk in their portfolios — down to the single-stock level, daily.

Because elevated macro vol eats into alpha