Macro Risk and Gold:

What the data tells us

1. Small Cap rotation is hostageto inflation

2. Rate Volatility - the BlindSpot in Equity Risk

3. Rising Rate Vol - the AchillesHeel of IBB

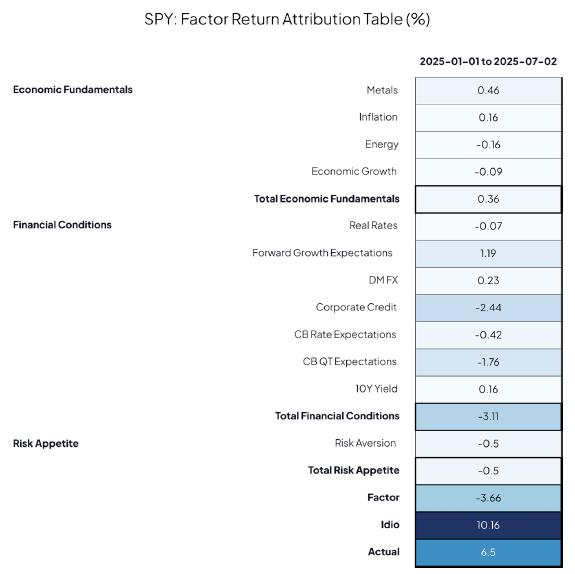

In recent analysis, we have established that rising macro risk is bad news for investors.

It eats into risk-adjusted returns—because you can’t control it.

It compresses profit multiples—because investors won’t pay up for uncertain futures.

We track macro’s share of risk. Our z-score measure for the market tells us when macro shocks are dominating price action—the fear factor, quantified.

Overlay this with the gold-to-equity ratio (XAU/SPY) and you see something striking: Gold hasn't just kept up with rising macro risk—it’s outpaced it. A safe haven / store of value doing its job... and then some. We also flag that junior gold miners (GDXJ) are trading with extreme sensitivity to risk aversion—pricing in a lot of fear already.

So where next?

Markets will likely stay in "recession watch" mode until hard data catches up. But nothing moves in straight lines—including gold. We can help identify what macro is doing to your portfolio.