US vs. RoW Equities YTD – Macro in Driver’s Seat, Not Idio Alpha

1. Small Cap rotation is hostageto inflation

2. Rate Volatility - the BlindSpot in Equity Risk

3. Rising Rate Vol - the AchillesHeel of IBB

SPY +1% YTD vs. ACWX (MSCI World ex US) +14% YTD: 13% US vs. RoW Underperformance

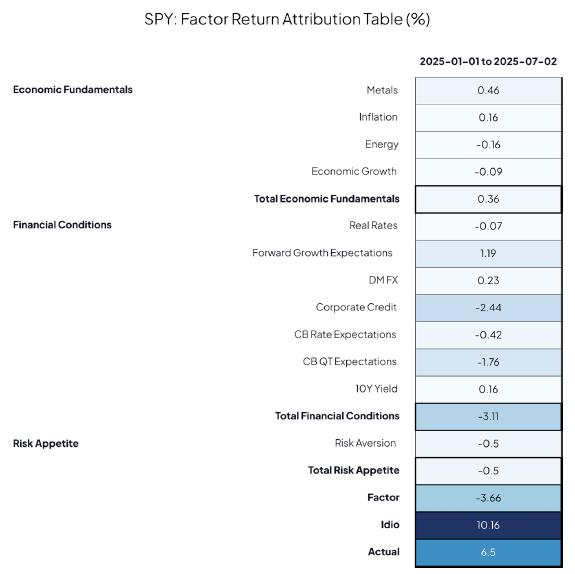

Qi’s Risk Model breaks it down

- 69% Macro (-9%)

- 31% Non-Macro / Idiosyncratic (-4%)

Explaining the Macro Drag:

- Dollar weakness = -5%

US investors in RoW assets got a 5%FX boost when converting back to USD

- Copper strength = -2%

Reflects RoW’s heavier exposure to commodities vs. tech/growth-heavy US

- US HY credit widening = ~-2%

CDX HY spreads widened ~50bps more than other regions, e.g. Euro HY

What’s interesting?

The idio drag (-4%) has gone nowhere since March! See the first chart.

The bulk of the RoW relative “alpha”i.e. a better fundamental opportunity set in anticipation of RoW fiscal stimulus / DeepSeek news was really during first 2mth of Q1.

Why it matters?

If macro headwinds fade — think stronger dollar, weaker copper, tighter credit — the US would regain footing.

But for RoW to extend its lead OUTSIDE of macro drivers?Might need a new catalyst — a fresh DeepSeek moment — because idio alpha i.e.what can be explained outside of macro…is stalling.

Qi reveals how dominant macro is in your portfolio.