Winners vs Losers from Higher Real Rates

1. Small Cap rotation is hostageto inflation

2. Rate Volatility - the BlindSpot in Equity Risk

3. Rising Rate Vol - the AchillesHeel of IBB

Only a few months ago, the passing of the US Tax Bill was seen as a summer energizer for stocks.

Instead, the structural concerns on long-end rates continue to simmer – whether that’s the size of the fiscal deficit, foreign demand for USTs or underlying inflationary pressures.

The result?

A grind higher in term premia.

The “high” from the US / China tariff capitulation 2wks back is hard to repeat. In fact, Japan / EU US talks seem to be now dragging.

Are we running out of catalysts and back to the “worry window” (PEs up but EPS bleeds)?

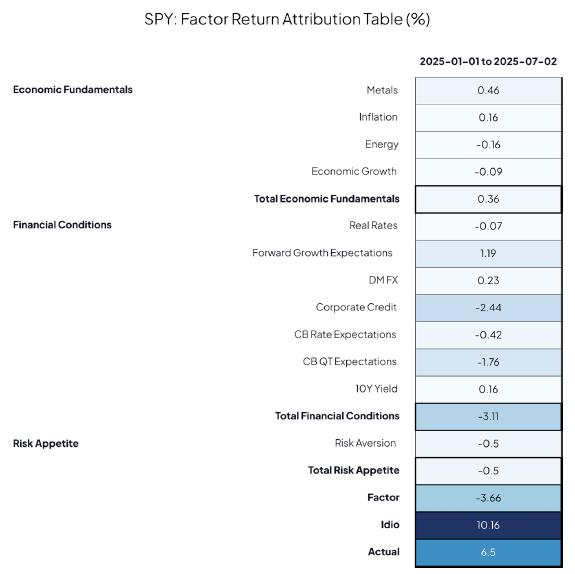

Qi’s Risk Model helps cut through the noise.

What macro bet is your portfolio really making?

Positive or negative exposure – what’s the relationship?

Big or small macro beta – does it matter?

With the spotlight on long-end rates, we screened for the Top 20 winners / losers from rising 10yr real yields. Chart below shows how tightly performance is tracking those yields.

See these names below - broadly technology vs. real estate / homebuilders / certain utilitiesThe corner of the economy that depends most on long end yields is US housing, which relies on 30 year mortgage financing for the vast majority of loans. If 30 year yields were to rise uncontrollably to 6 or 7%, that would equate to mortgage rates in the vicinity of 8-10%.