1. Time for Dollar pause

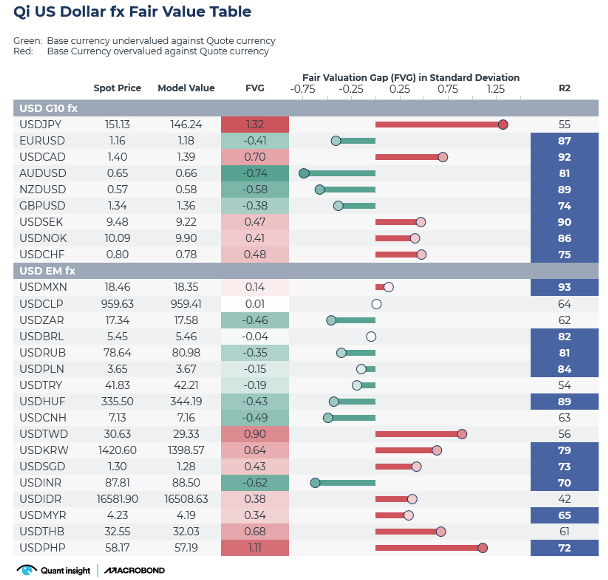

Qi's snapshot of global FX shows the Dollar as rich versus a wide range of both DM & EM currencies.

But there are some interesting nuances:

· the Dollar is consistently rich versus its G7 peers with USDJPY the standout. Interesting in the context of a fractured Parliament which could curb Takaichi’s easy- policy plans, challenging the weak-Yen consensus.

· $-Asia is the main EM mover; $-LatAm typically sits near fair value.

· what commodity super cycle? Given the bull narrative around real resources, why aren't AUD, Kiwi, CAD doing better?

Read more by downloading the PDF below