1. Brazil - macro vs. politics

2. Where are the bond vigilantes?

3. QQQ vs. QQEW

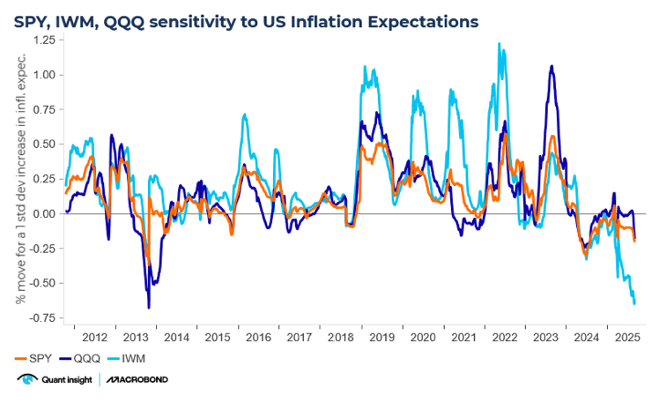

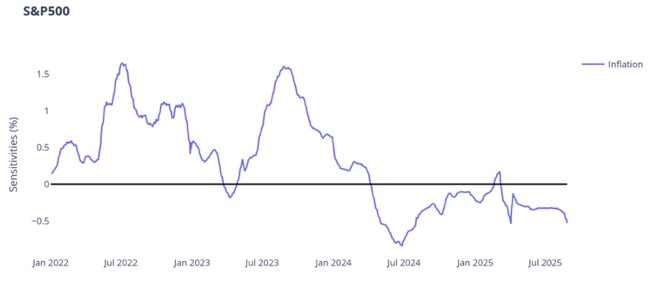

1. Small Cap rotation is hostageto inflation

2. Rate Volatility - the BlindSpot in Equity Risk

3. Rising Rate Vol - the AchillesHeel of IBB

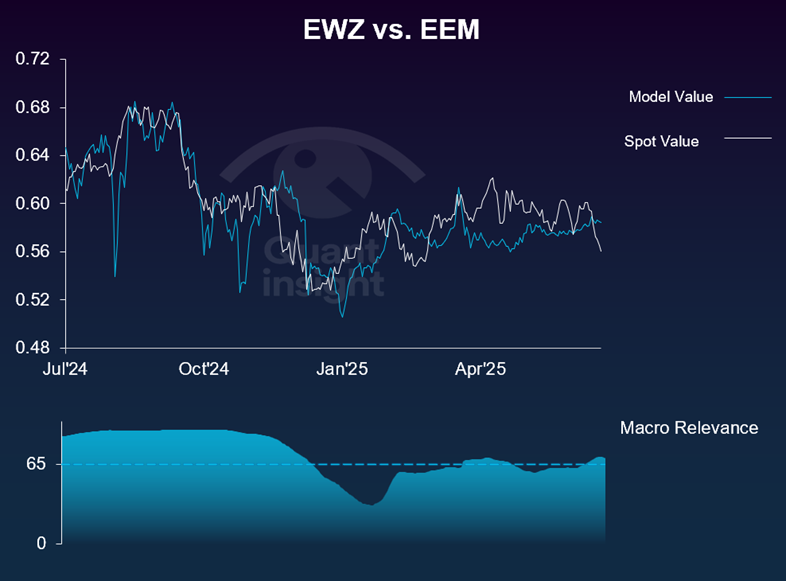

1. Brazil – macro vs. politics

Aside from the size of the tariff itself, the standout in President Trump's latest salvo against Brazil was the overt political motivation. It is interesting therefore to note that Qi's model of EWZ versus EEM has just moved back into a macro regime with model confidence back over 65%.

And while politics has driven the latest spate of EWZ underperformance, macro-warranted model value continues to grind higher. Brazilian equities now sit 1 sigma (4%) cheap relative to the broader EM universe.

This is the relative value not outright where EWZ sits a more modest 0.4 sigma (2.3%) cheap to macro conditions. Still the broad point holds - for those happy to look through tariff headlines, value is starting to build in Brazilian stocks.

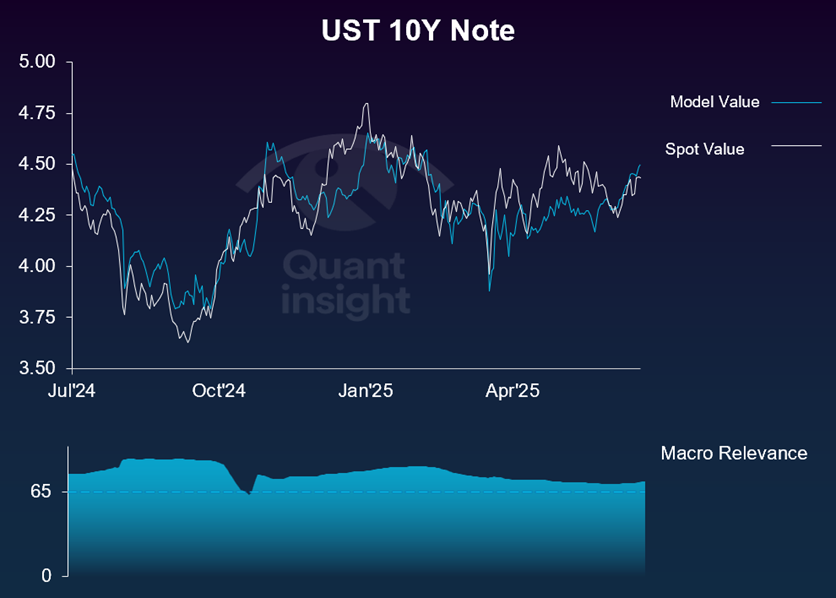

2. Where are the bond vigilantes?

The bear case for bonds was already well established. Now, with Fed independence under threat, the bears have additional momentum. On Qi, macro-warranted value has risen 38bp in the last month & now sits at 4.53%. The rise in inflation expectations is the single biggest driver of that model value move.

10s are slightly lagging that deterioration in macro conditions - they sit 0.2 sigma (2.5bp) below macrofair value. That's a very modest Fair Value Gap, so no signal.

More a reminder to closely watch Qi model value. High and stable R-Squared means the model is doing a good job at explaining the variance in 10y Treasury yields. Qi will capture how shifts in inflation - an effective real time gauge of the threat to Fed independence - and indeed the entire macro complex is impacting the Treasury market.

3. QQQ vs. QQEW

The issue of poor breadth is one again raising its head and prompting some investors to question the health of the recent US equity market rally.

From Qi's macro perspective, the market cap weighted QQQ ETF now sits 1.25 sigma (2.2%) rich relative to the equal weighted NASDAQ ETF QQEW. That is very much the rich end of recent FVG ranges.

There is a health warning - 49% modelconfidence means the AI story is more important than macro. But this is another sign suggesting US mega cap tech stocks have already carried this rally a long way.

Current patterns show QQQ wants lower inflation expectations to outperform QQEW. So the recent surge in inflation expectations is suppressing Qi model value & effectively explains the FVG.

So, at these rarified valuation levels, QQQ either needs additional good news to fuel momentum in the AI trade; or it needs inflation expectations to calm down. Put another way, with this much good news in the price, the Mag7 are not immune to fears around Fed independence.

.png)